Thomas Fazi

Italy’s latest budget bill – approved just a few days ago – confirms what many government critics have been saying all along: Matteo Renzi’s anti-austerity rhetoric is nothing more than that. Ever since his appointment as prime minister, in February 2014, Renzi has been an outspoken critic of austerity. Recent headlines – often accompanied by colourful accounts of epic behind-the-scenes clashes between Rome and Brussels (and/or Berlin) – include ‘Austerity only good for Germany, says Renzi’, ‘Renzi rips into Merkel over austerity’ and ‘Renzi attacks EU’s “therapeutic obstinacy” with austerity’. Following the recent earthquake in central Italy, Renzi pledged to ‘take whatever [budget flexibility] we need’ for his reconstruction plan, amidst expressions of support from various European leaders, including Angela Merkel (who said that Renzi would get a ‘sympathetic hearing’ over his plan).

The post-earthquake solidarity was short-lived, though. A few weeks later, at the EU crisis summit in Bratislava, Renzi deserted the final press conference with his German and French counterparts because of disagreements over the economy and immigration. In the days leading up to the publication of the budget bill it became apparent that Renzi’s pleas for greater flexibility had fallen on deaf ears. First came Jens Weidmann, the infamous Bundesbank president, who accused Italy of ‘abusing’ the flexibility clause contained in the Stability and Growth Pact (SGP) and urged Renzi to focus on structural reforms and debt reduction. Then it was the turn of Pierre Moscovici, the European Commissioner for Economic and Financial Affairs, who stated that the SGP ‘works fine’ and ruled out granting further flexibility to Italy (even though he had just given Spain and Portugal reprieve from EU budget rules for running much higher deficits than Italy – twice as much in Spain’s case). Finally, Mario Draghi cut the dispute short by declaring that EU rules already provide for ‘a lot of flexibility’ and that ‘countries… should think more about the composition rather than the size of their budgets’ (despite his numerous calls in recent months for greater fiscal support to the ECB’s quantitative easing (QE) policies).

In view of the two sides’ official positions – on one hand a prime minister who has repeatedly denounced the eurozone’s fiscal rules, and is in charge of a country facing the longest and deepest recession in its history, on the other a European establishment that insists on further austerity – an uninformed observer could be forgiven for expecting Renzi to defy EU rules and unilaterally hike the deficit. Everyone else in Europe appears to be breaching the rules: not only are Spain, Portugal, France and Greece well above the SGP’s 3 per cent deficit-to-GDP limit, but Germany has been aggressively violating the EU’s trade surplus rules for years.

But our imaginary observer would have been disappointed: not only does the recent budget bill not foresee an increase of Italy’s fiscal deficit in 2017; it actually foresees a reduction from 2.6 per cent now to 2.4 per cent. And not because the economy is expected to magically start growing – the estimated GDP growth rate for 2017 is a meagre (and overoptimistic) 1 per cent – but because the government has shamefully accepted to implement further austerity measures, in the form of additional budget cuts (even though Italy has reduced government expenditure more than any other member state since the start of the crisis).

To understand the disastrous implications of this decision it is important to understand the distinction between the primary budget balance and the overall budget balance. It is a common misconception that when we talk of ‘budget deficits’ we are talking uniquely of government revenues minus expenses: that is, governments spending more than they collect in taxes. However, the overall budget balance includes the interest payments on the existing debt. The primary balance, on the other hand, refers to how much a government earns, minus what it spends, not including interest payments on the existing debt – so logically this is the measure that we should look at when assessing whether a country is pursuing an expansionary or contractionary fiscal stance, and whether we are dealing with a ‘virtuous’ or ‘profligate’ nation, in the parlance of our times.

The primary balance and the overall balance don’t always point in the same direction, of course: if a country has a high interest expenditure in relation to GDP, you can have a situation where the primary balance is in surplus (that is, the government earns more than it spends) but the overall balance is in deficit, because the primary balance is not sufficient to cover all interest payments, meaning that the country has to issue new debt simply to service its existing debt.

Become a Social Europe Member

Support independent publishing and progressive ideas by becoming a Social Europe member for less than 5 Euro per month. Your support makes all the difference!

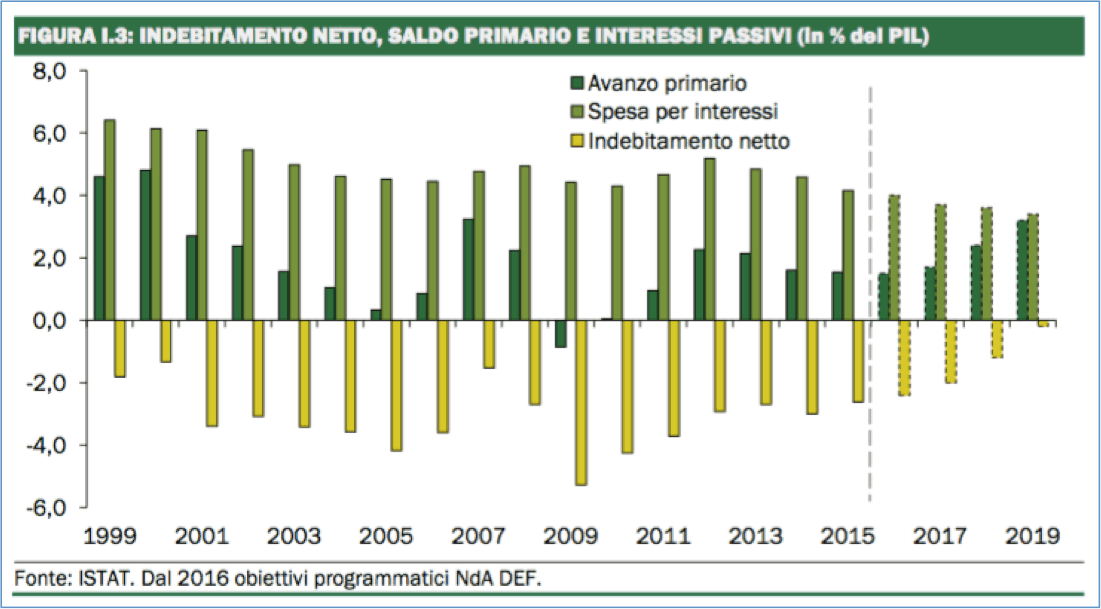

This is Italy’s case: despite its reputation as a reckless spender, it is one of the few countries in Europe (and in the world) to have run a significant primary surplus – meaning that, on average, it has consistently earned more than it has spent, excluding interest payments – since the early 1990s.

However, this has never been sufficient to cover the country’s high rate of interest expenditure, averaging around 5 per cent of GDP since 2000 (a legacy of the sky-high interest rates of the 1980s), so the state has had to take on new debt each year simply to service its old debt – hence the overall deficit. The same goes for a number of other countries: according to data from the European Commission, between 1992 and 2008 the eurozone has constantly registered a primary surplus. Even if we look at the ‘profligate’ PIIGS (Portugal, Italy, Ireland, Greece and Spain) we see that before 2008, three (Italy, Ireland and Spain) had primary budget surpluses and one (Portugal) had a near-balanced primary budget. Greece was the only country with a serious primary budget deficit.

This does not mean that Italy and the others should be praised for such budgetary policies. On the contrary, there is convincing evidence that such restrictive budgetary policies – pursued since the early 1990s by all EMU countries to meet the Maastricht convergence criteria – are one of the leading causes of the stagnant growth rates over that period. That is certainly the case for Italy. But it does put to shame the EU’s post-crisis mantra that European countries need(ed) to ‘put their fiscal house in order’. It also shows that the purpose (or at least, one purpose) of the post-crisis austerity policies was never to help the troubled countries of the eurozone, but simply to re-establish their debt-servicing capacity. The cuts and tax hikes did not make European governments any richer, or their public finances any more sustainable (quite the contrary, in fact, given the well-documented recessionary effects of these policies); the money ‘saved’ by cutting back on crucial public services went straight into the pockets of the creditors. Finally, it shows how surreal the whole European debate over ‘flexibility’ is: what is at stake is not whether governments should be allowed to run higher primary deficits, but how fast they should increase their primary surpluses.

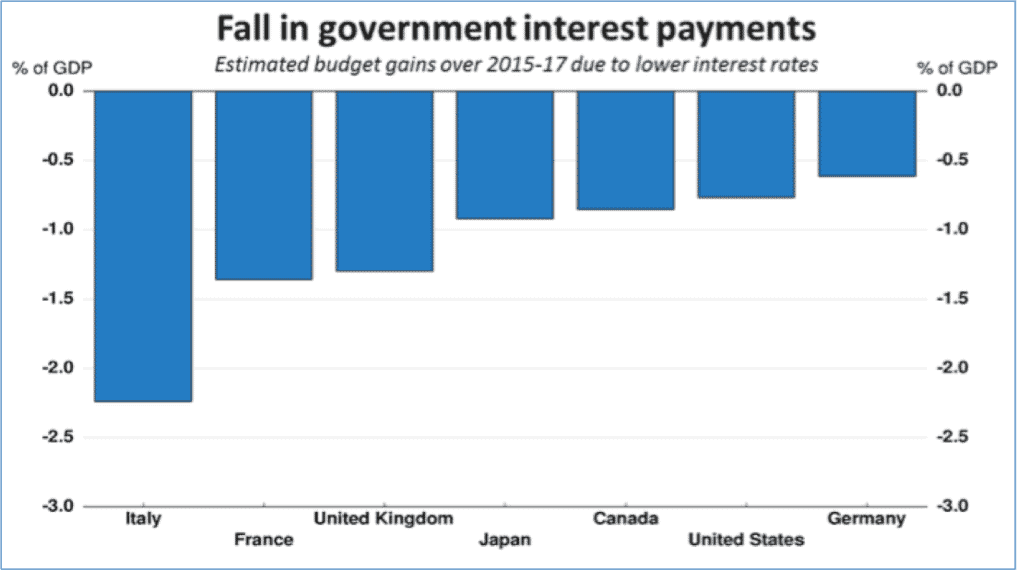

Coming back to Italy’s latest budget bill: its contractionary nature is confirmed by the estimated rise in the primary surplus, from 1.5 to 1.7 per cent in 2017. This is bound to further depress the Italian economy, as the government knows perfectly well. None other than the country’s finance minister, Pier Carlo Padoan, acknowledged in a recent interview with the daily Il Messaggero that ‘the reduction of public expenditure in Italy has led to lower growth rates than other countries’. What’s worse, though, is the fact that this further fiscal tightening will take place despite an estimated reduction in the country’s interest expenditure over the 2015-2017 period of around 2 per cent of GDP, thanks to the ECB’s ultra-low interest rate policies. So much for the ‘fiscal space’ that QE was supposed to free up for governments; at best one could argue that austerity would have been even greater without it.

But this latest development should not come as a surprise. Despite the prime minister’s bombastic anti-austerity rhetoric, the truth is that since he came to power Italy’s primary balance has been constantly rising and the overall balance constantly decreasing. Something that the country’s disastrous economic performance in recent years shows all too well.

Italy: overall budget balance (yellow bar), primary balance (dark green bar) and interest payments (light green bar)

Therefore one can only conclude that either: (a) Renzi never had any intention of seriously challenging austerity, which would make him the greatest snake oil salesman since Berlusconi; or (b) his idea of challenging austerity is to constantly denounce the rules while making a point of being the only government in Europe to follow them, possibly in a perverse attempt to prove their uselessness by committing economic harakiri. Either way, Italy is firmly on course for a second lost decade as a result of Renzi’s abysmal policies.

Thomas Fazi is a writer, journalist and activist. He is the author of "The Battle for Europe: How an Elite Hijacked a Continent – and How We Can Take It" Back (Pluto, 2014) and "Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World", co-authored with economist Bill Mitchell (Pluto, 2017).