The strong fiscal-policy response from the European Union needed to deal with the severe economic shock represented by the Covid-19 pandemic was only made possible by finance ministers agreeing on March 23rd, for the first time, to activate the ‘general escape clause’ of the EU fiscal framework. It is very likely, however, that that clause will be reinvoked in 2021 and 2022. But what happens if the conventional rules are reinstated?

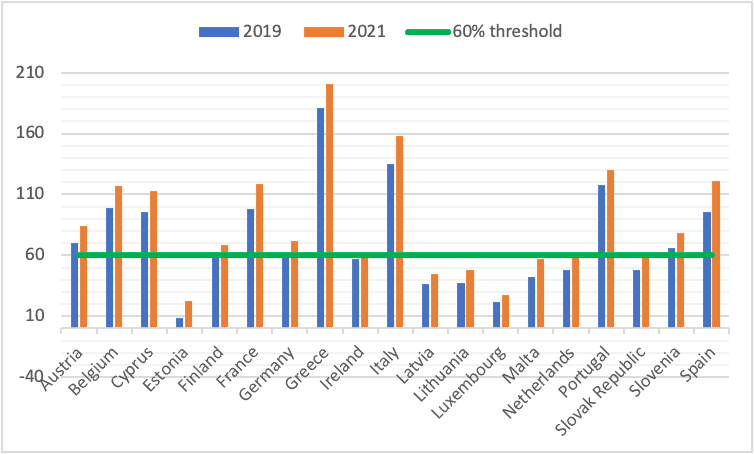

During the pandemic the state of public finances in all countries has deteriorated significantly. According to forecasts by the International Monetary Fund, in several euro-area member states in 2021 the ratio of debt to gross domestic product will be around double (Belgium, France, Spain and Portugal) or even triple (Italy, Greece) the 60 per cent ceiling set by the Maastricht treaty (Figure 1).

Figure 1: euro-area member states’ gross debt, 2021 (% of GDP)

These high debts raise huge challenges for fiscal policy in the member states. The so-called ‘six pack’, which came into force in December 2011, obliges them to reduce the difference between their current debt and the 60 per cent benchmark by one 20th per annum. As calculations by the European Fiscal Board show, the requirement to bring debt below that limit within two decades implies running high budget primary surpluses.

Even under benign conditions (nominal growth exceeding the nominal interest rate by half a percentage point), countries with a debt-to-GDP ratio of 120 per cent must achieve a primary surplus of 1.9 per cent, countries with a debt-to-GDP ratio of 150 per cent a surplus of 2.9 per cent. Comparing these figures with the average primary surpluses the highly indebted euro-area member states were able to achieve between 2014 and 2019, it obvious that the required debt reduction could only be realised with brutal austerity (Table 1).

Table 1: highly indebted euro-area member states: debt-to-GDP ratio and average primary surplus 2014-19 (%)

| Country | Debt ratio (2021) | Primary balance (2014-19) |

| Belgium | 117.1 | 0.3 |

| France | 118.6 | -1.5 |

| Portugal | 130.0 | 0.9 |

| Spain | 121.3 | -1.5 |

| Italy | 158.3 | 1.4 |

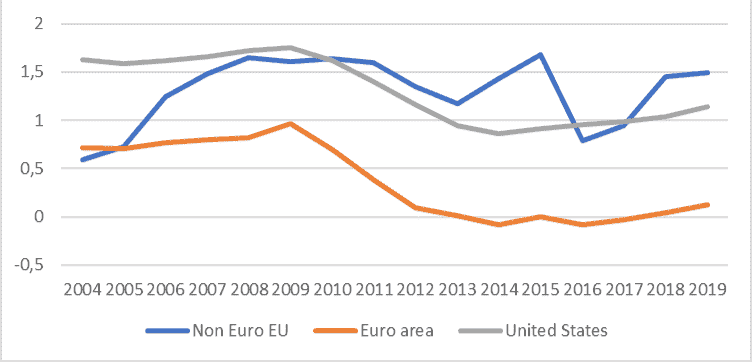

The experience of the last decade shows that fiscal consolidation has a negative impact on public investment, as such expenditure is easier to cut than social spending or salaries for the public sector (Figure 2).

Figure 2: public investment as a share of current primary expenditure (1997-2018)

This outcome is hardly surprising, as public investment does not play a relevant role in the framework of the Stability and Growth Pact. The anchor of its rule book is the ratio of gross public debt to GDP—taking in the liabilities of the public balance sheet without any reference to public capital stock on the asset side. Nor does the 3 per cent budget-deficit constraint discount public investment. As the EFB points out, the so-called investment clause, which provides some leeway for debt-financed public investment, has rarely been invoked, primarily because it requires a negative growth forecast or an ‘output gap’ below 1.5 per cent of potential GDP.

As a result, since 2012 net public investment in the euro area has been close to or even below zero (Figure 3). It has been much lower than in the EU member states outside of the eurozone and in the United States.

Figure 3: net public investment in the euro area, other EU member states and the US (% GDP)

Restoring this fiscal framework after the exceptional regime of the Covid-19 crisis would thus make it impossible to finance the huge public investments required to deal with the simultaneous challenges of climate change, the consequences of the pandemic and the digital transformation.

Starting point for reform

An obvious starting point for reform of the Stability and Growth Pact is the 60 per cent anchor for public debt. It was derived as the average debt-to-GDP ratio of the EU member states in 1990. With the same procedure, a reference value of 70 per cent could be calculated for 2000, of 86 per cent for 2010 and 101 per cent for 2020.

Academic economists have been unable to derive scientifically a benchmark with which evidence-based economic policy should comply. A prominent instance was the 2010 paper by Reinhart and Rogoff which tried to establish a reference value of 90 per cent but was found to suffer from ‘serious miscalculations’. A 2014 IMF working paper concluded:

Our results do not identify any clear debt threshold above which medium-term growth prospects are dramatically compromised. On the contrary, the association between debt and medium-term growth becomes rather weak at high levels of debt, especially when controlling for the average growth performance of country peers.

As a consequence of this ambiguity, a former IMF chief economist and colleagues have recently proposed to replace fiscal rules by ‘fiscal standards’:

Whether debt is at risk of becoming unsustainable does not just depend on debt and deficit levels but on a host of uncertain economic and political factors. Fiscal rules, even complex ones, cannot account for this uncertainty, because it is impossible to predict and specify the relevant contingencies ex ante. Rules are bound to lead to mistakes, constraining fiscal policy either too much or too little.

The key decision for eurozone members is whether they are willing to abandon, or significantly weaken, the debt-reduction rule of the ‘six pack’. A new rule might taper the period for adjustment to 50 years or the same goal could be achieved on a discretionary basis, with country-specific medium-term debt targets decided by the European Commission and the Council of the EU.

Golden rule

Depending on interest rates and on projected nominal growth rates, such debt targets could leave room for primary deficits. To guarantee that this fiscal space was used for investments, the approach should be supplemented by a golden rule. Such a rule—the notion that public borrowing should finance investment but not mere day-to-day spending—has the advantage over debt rules that it is widely accepted among economists. Even the conservative German Council of Economic Experts, when developing the country’s debt brake (Schuldenbremse) in 2007, explicitly included the golden rule.

The advantages and problems associated with the golden rule have been intensively discussed. The main problem is an adequate definition of investment. Should it be defined as gross or net? And should it be limited to ‘bricks and mortar’ or defined in a more encompassing way as ‘future-oriented’ investments—including public expenditures on education and families, on better health systems and the fight against climate change?

Pragmatically, public investment could be defined as net investment plus all expenditures related to education, climate change, digitalisation and research and development exceeding the average of 2014 to 2019. Categorisation of expenditures as coming under the golden rule should require the approval of independent national fiscal watchdogs.

Within such a framework an expenditure rule could play an important role—in fact, many fiscal-policy reform proposals favour it. But to derive the concrete expenditure path a proper target for debt levels must first be established. Then a golden rule can ensure that a possible space for deficits is used for broadly defined public investment.

This article is a joint publication by Social Europe and IPS-Journal

Peter Bofinger is professor of economics at Würzburg University and a former member of the German Council of Economic Experts.